Knight Frank’s 2024 Wealth Report reveals the latest luxury investment trends and which collectibles are breaking records.

The property specialist’s annual review provides valuable insight on emerging investment patterns led by ultra-high net worth investors (UHNWIs) around the world. A key one being that on average 20% of UHNWI portfolio value is held in luxury assets.

Where there’s pain – there’s gain

A twist on the old ‘no pain, no gain’ adage, Knight Frank’s latest annual review shows that, whilst luxury asset markets suffered downward pressure in 2023, there were still pockets of growth and some outstanding individual performances in all luxury asset classes.

Top luxury asset sales in 2023

| Asset class | Auction House & Item | Price (USD) |

|---|---|---|

| Art | Sotheby’s: Picasso's ‘Femme a la Montre’ | $139.4m |

| Car | Sotheby’s: 1962 Ferrari 330 LM/250 GTO | $51.7m |

| Jewellery | Christies: Bleu Royal ring featuring 17.61 carat fancy vivid blue diamond | $43.8m |

| Coloured diamond | Sotheby’s: The Eternal Pink, 10.57 carat fancy vivid pink diamond | $34.8m |

| Watch | Christies: Patek-Philippe Ref2523J gold two-crown world-time wristwatch | $8.5m |

| Furniture | Sotheby’s: Louis XVI gilt walnut chair for Marie-Antoinette | $2.8m |

| Coin | Great Collections: 1795 US$10 Capped Bust Gold Eagle 9 leaves | $2.7m |

| Whisky bottle | Sotheby’s: The Macallan Adami 1926 (bottle) | $2.7m |

| Handbag | Christies: Hermès Himalaya Niloticus crocodile diamond Birkin 25 with 18K white gold and diamond hardware | $0.36m |

| Fine Wine | Sotheby’s: Domaine de la Romanée Conti, Romanée Conti 1999, five magnums lot | $0.28m |

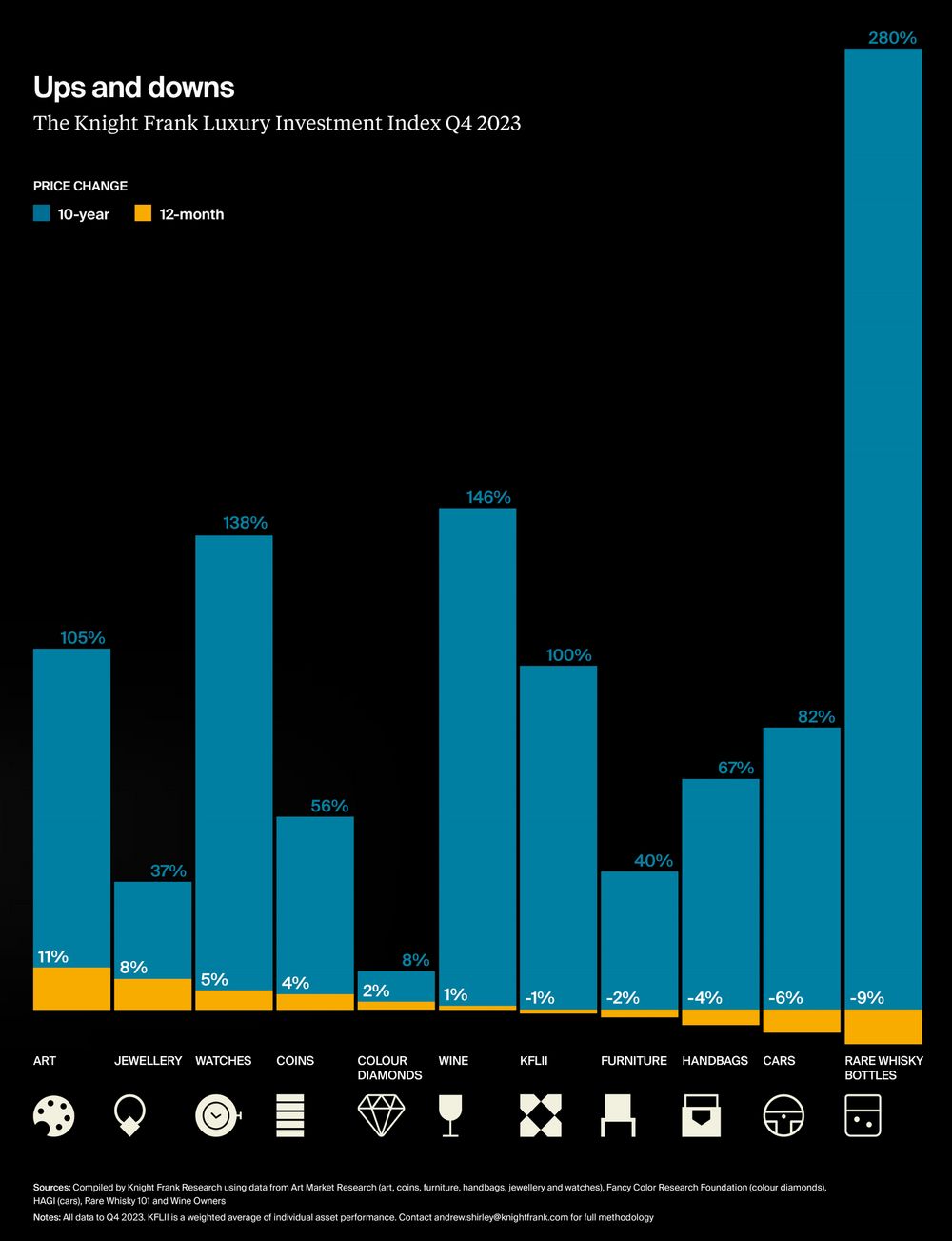

Knight Frank’s Luxury Investment Index (KFLII) records the performance of a ‘basket of ten asset classes’ which includes art, classic cars, coins, coloured diamonds, fine wine, furniture, handbags, jewellery, watches, and whisky. The KFLII recorded a general negative -1% trend in luxury investments in 2023, just the second time this index has chronicled a downward turn. That said, some assets held value better than others and longer term are still protecting wealth.

Key reasons to collect luxury assets

Often also referred to as 'Passion Assets', the Knight Frank Attitudes Survey also revealed the top five reasons for UHNWIs acquiring these collectables:

- The joy of ownership

- Investment

- Status among peers

- To belong to a community

- Intellectual interest

Source: Knight Frank wealth Report 2024

Luxury Asset performance

Collectable luxury investments generally deliver stronger returns over the long term and the Knight Frank data illustrates this. It's important to note that the one-year measure in 2023 coincided with a period of significant price adjustment across the luxury sector overall. Five out of the ten KFLII classes ended the year in negative territory, but five also managed to hold value and grow.

Art assets

Knight Frank’s 2024 Attitude Survey of wealth professionals found that 48% of their global UHNWI clients consider art a popular acquisition.

With data provided by Art Market Research (AMR), art led the KFLII and was the only luxury asset in 2023 to see double-digit growth. The 11% recorded was derived from a strong performance in the first half of 2023. Prices slipped away in H2 as buyer’s exerted increased pressure. A perceived glut of supply of contemporary art triggered stronger price drift.

Our view - In terms of accessibility, art comes at all price points, but it is a particularly opaque market when it comes to valuations. Art is very subjective and valuing a unique piece is challenging. Sales are very often driven by auctions or undertaken privately and a few high profile, significant sales have a strong influence over average values.

Whilst historic price information is more available, the secondary market in art cannot be referred to as efficient. The upsides can be very significant, particularly for rare masters and the most celebrated artists, as illustrated by the 2023 sale of Picasso’s ‘Femme a la Montre’ at US$139.4M.

Watches; a winning investment?

Survey finding: 42% of global UHNWIs see watches as a popular investment.

A solid performer, rare watches have consistently been in the top three luxury assets in terms of price growth and managed to do so again in 2023 and over the ten-year period. Despite challenging market conditions, the KFLII data shows collectable watches saw an average gain of 5% last year.

The Wealth Report states that the collective sale of watches by the three largest auction houses exceeded £488M last year, a slight increase on 2022. Key brands for investors remain Patek-Philippe and Rolex, and in 2023 Richard Mille, Roger Smith and Cartier saw increased demand. The Middle East is a strong market with 67% of UHNWIs interested in luxury watches.

Classic cars driving value

Survey finding: 38% of global UHNWIs see classic cars as a popular investment.

The sale of an extremely rare 1962 Ferrari 330 LM/250 GTO provided ‘va va voom’ to the classic car market in 2023, selling for over US$.51M. But the sector had a challenging year, the second worst performer of the KFLII with an average decline of -6%. The Report pointed to a younger investor braving the market trend to acquire key brands BMW and Lamborghini, supporting growth in these two marques.

Our view - At the top level the market is very small and any change in price dynamic has a significant impact. The costs of owning classic cars including secure storage and maintenance are a factor for investors to consider and again valuations can lack transparency. There is more pricing information available, with HAGI a key source, but investing in classic cars is certainly more for the passionate petrolhead!

Is Jewellery a sparkling investment?

The second-best performing luxury asset class in the KFLII in 2023. This could be in part because this sector did not experience the heights of the rush for tangibles fine wine and other assets enjoyed in the post pandemic boom. Notably, its longer term performance of 37% growth is considerably weaker than the top three performing assets whisky, wine and watches over ten years.

Major movers in this sector last year were extremely rare pieces, such as the Bleu Royal ring featuring a 17.61 carat fancy vivid blue diamond, which sold for over US$43M. The influence of hip-hop culture, being also felt in wine with adopters such as Jay-Z, made their mark in jewellery. The Wealth Report cites Drake’s purchase of Tupac’s gold, ruby and diamond crown ring for US$1M as a sign of the times.

Coloured diamonds have also managed to stay positive with average 2% growth in 2023, but longer-term 10-year performance of 37% is more muted.

Our view - Diamonds maybe ‘a girl’s best friend’, but perhaps it’s more about enjoying the sparkle than the returns.

Whisky winnings

The KFLII records whisky as an outstanding 10-year investment delivering 280% growth, ranking it first, but this is notably driven by a small number of key transactions. The 2023 sale of a bottle of The Macallan Adami 1926 for US$2.7M is a classic example.

In the last three years, whisky’s short-term performance has been modest, and more recently suffered a negative trend. In 2023 data provided to Knight Frank by Rare Whisky 101 records an average -9% decline in prices. You could argue this is negligible given the long term performance and perhaps only part of a necessary adjustment.

Our view - We recently reviewed wine and whisky investments and how they compare. Extremely rare, signature single malts can achieve whopping values over the long term. But this scarcity means small movements can have big impacts on investment data. Tax treatment for whisky bottles also differs from fine wine and investors need to be aware.

Fine wine - a liquid asset

Survey finding: 35% of global UHNWIs see fine wine as a popular investment

Consistently a top performing luxury asset, fine wine delivers stronger returns over the long term. In 2023, data provided by Wine Owners, ranked wine second to whisky in the Knight Frank grouping with average 146% growth over the 10-year period to 31st December 2023.

In the short term, fine wine still compares well with the other luxury assets. Wine Owners’ portfolio showed returns above the KFLII average of -1%, recording 1% growth across 2023 in a challenging year for fine wine. They also pointed to Burgundy’s smaller producers with tight supply, which suffered some of the hardest corrections and an average -12% adjustment in their portfolio from the region.

Our view – We have commented on the pricing dynamics throughout the adjustment period. There are some indicators in Q1 2024 of sections of the market potentially reaching a levelling-out point but there is still some volatility and prices are not firming to an upward trajectory yet.

Longer term performance still stands up with the Liv-ex Champagne 50 index recording 50.2% growth and the Liv-ex Italy 100 a 31.8% rise in the five years to the 29th February 2024.

The value of having a well-diversified wine portfolio including more liquid Bordeaux icons and key Italian wines was clear in 2023. The price correction has run since November 2022 and particularly impacted those regions and wines that enjoyed the strongest growth during the 2020-2022 bull run. At the end of Q1 2024 we are firmly in a ‘Buyers’ market’ and investors can secure important investment wines at prices offering strong potential for future growth.

Once again, we would point to the following reasons to add fine wine to an investment portfolio:

- Accessibility - some investment Champagne and Italian wines are available for prices around £1,500 and currently available at a potential market low

- Price transparency – Liv-ex.com provides a stock-exchange function with over 600 global merchant members providing live transaction price information.

- A more robust and efficient fine wine secondary market with established routes to market and efficient transaction mechanisms ensuring ease of trade and trustworthy market information.

- Liquidity – Fine wine transactions are not reliant on auction houses, Liv-ex.com provides efficient trading and investment grade and collectable fine wine can generally be sold when required.

- Cost-effective – as with many luxury assets there are costs involved in terms of ongoing storage and insurance, but these are not the significant factor they are for other collectables.

- Tax efficient – find out more from our specially commissioned Tax & Fine Wine Report.

Our view on investing in luxury assets in 2024

The luxury sector overall felt the negative impact of high inflation and interest rates triggered by the pandemic and war in Ukraine in 2023. Buyers grabbed the bull by the horns and the resultant price adjustment for all classes was the main theme last year. That said there have still been some outstanding luxury transactions illustrating the star power and resilience.

As a result, 2024 has started with rising discounts for luxury assets and the sector is attracting new and younger buyers into certain markets.

With respect to our specialist market, fine wine, we still maintain that this year could be a rare opportunity to add significant future value and strong diversification strategies to an existing wine portfolio. It’s also an opportunistic period to enter the market as a new wine investor.

You can download Knight Frank’s 2024 Wealth Report and for more information on investing in fine wine, see our Guide and speak to a member of our expert team on 0203 384 2262.