Burgundy’s top price performer in 2022 enjoyed average growth of 487% for its wines, way above the regional average of 26.7%. So, can investors expect more from Burgundy in 2023?

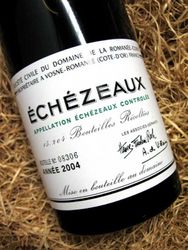

The leading wine region when measured by Average Trade Price and long-term asset performance of its wines, Burgundy’s wine investment value is driven by rarity, where Bordeaux is strongly influenced by critical scores. The legendary wines of the region have become the ‘Holy Grail’ for collectors and wine investors, they are so hard to get hold of and, as a result, often the most expensive wines in the world.

A complex region to understand with intricate land ownership, small vineyard plots providing very low production, and scarce supply of Burgundy to a global market clamouring for the top labels. The ‘elite’ Burgundy Grands Crus represent the highest entry point into the fine wine market.

Burgundy’s Top 10 most Powerful Fine wine brands in 2022

| Burgundy wine producer | Power 100 ranking 2022 | Power 100 ranking 2021 |

1 | Leroy | 1 | 1 |

2 | Arnoux Lachaux | 2 | 62 |

3 | Leflaive | 3 | 13 |

4 | Armand Rousseau | 4 | 3 |

5 | Prieure Roch | 5 | 38 |

6 | De La Romanée Conti | 8 | 5 |

7 | Jacques Frederic Mugnier | 9 | 47 |

8 | Faiveley | 12 | 56 |

9 | Georges Roumier | 15 | 34 |

10 | Dujac | 16 | 30 |

Source: Liv-ex Power 100 Report, 2022

Demand from value-seeking connoisseurs and investors has broadened the focus outside of the iconic labels since 2018, when the prices last peaked. This trend has led to the region’s Premier Crus and now Village wines to be traded on the secondary market. Burgundy’s trade share reached a record 25.9% in 2022, with the number of wines traded rising to a record 4,306.

Top 10 Burgundy brands by price performance in 2022

Rank | Burgundy wine producer | Average market price growth |

1 | Arnoux Lachaux | 487.2% |

2 | D’Auvenay | 127.2% |

3 | Leflaive | 94.1% |

4 | Jacques-Frederic Mugnier | 85.8% |

5 | Pierre Yves Colin-Morey | 84.1% |

6 | Francois Raveneau | 71% |

7 | Sylvain Cathiard | 66.5% |

8 | Armand Rousseau | 63.5% |

9 | Dujac | 59.7% |

10 | Leroy | 59.5% |

Source: Liv-ex Power 100, 2022

Burgundy investment wines price performance

Price growth in Burgundy averaged 26.7% in 2022 and has stretched through the region’s AOC strata from the Domaines’ Grands Crus to the Village wines with newer Negociant labels, such as Charles Lachaux having seen some of the largest rises.

The price gap between Village and Grands Crus wines is closing as demand for the region’s wines continues to rise. Domaine Leflaive’s Grand Cru Batard Montrachet 2016’s price has grown 83.7% in five years. In contrast its Village wine Puligny-Montrachet 2016 has grown 283.6% in the same period.

The average Burgundy price growth by Classification:

Classification | Av. 2021 Price | Av. 2022 Price | Change |

Grand Cru | £5,327 | £8,007 | 50.3% |

Premier Cru | £1,531 | £2,010 | 31.3% |

Village | £950 | £1,498 | 57.7% |

Liv-ex Burgundy 2021 Vintage Report, January 2023.

Price inflation across all classifications has complicated the market and identifying potential for growth and price sustainability is an important consideration.

What do Burgundy’s historic price trends tell us?

- Previous Burgundy price peak was in 2018

- Prices declined 8.8% in 2019 as investors sought value and Trump imposed Tariffs

- Recovery in 2020 saw trade increase 31% as market demand soared

- Liv-ex Burgundy 150 rose 102.4% in 5 years to 31.12.2022

Following the previous peak in  Burgundy prices in 2018, buyers drew breath at the heady heights the region’s icons were achieving. The record auction of two 75cl bottles of Domaine de la Romanée Conti, Romanée Conti 1945 (75cl) at circa US$500,000 grabbed global headlines. Investors broadened their focus in the region and prices started to fall. Average trade prices declined 8.8% in 2019 as this dynamic was further exacerbated by President Trump’s imposition of US Tariffs which added a 25% premium to dollar buyers.

Burgundy prices in 2018, buyers drew breath at the heady heights the region’s icons were achieving. The record auction of two 75cl bottles of Domaine de la Romanée Conti, Romanée Conti 1945 (75cl) at circa US$500,000 grabbed global headlines. Investors broadened their focus in the region and prices started to fall. Average trade prices declined 8.8% in 2019 as this dynamic was further exacerbated by President Trump’s imposition of US Tariffs which added a 25% premium to dollar buyers.

What should be noted with hindsight is that trading volumes remained steady throughout the period and then Covid hit at the start of 2020! Investors worldwide looked for tangible, safe investments and the appetite for fine wine grew. With Burgundy’s Grands Crus offering value, investors piled in and as lockdown measures eased Burgundy’s key luxury hospitality markets returned and added momentum to the market.

Burgundy trade on the secondary market went up 31% in 2020 compared to 2019 levels. The number of active buy and sell bids on Liv-ex increased 34% and 79% on 2018, as the overall size of the Burgundy market expanded.

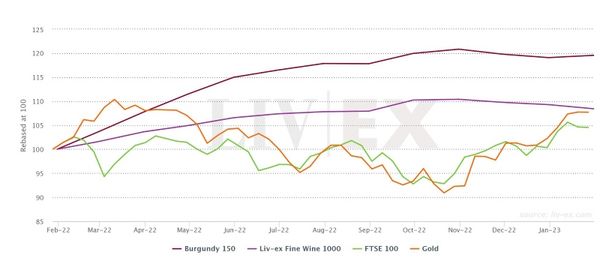

Burgundy compared to traditional investments

Burgundy has consistently outperformed the equities, property and other assets during the economic turmoil of the last few years. In 2022 UK property values grew 2%, the FTSE 100 rose just 0.9% and the Liv-ex Burgundy 150 soared 26.7%, double that of the Liv-ex 1000 broader fine wine market measure (13.1%).

Over the five years to 31.12.2022 the Burgundy 150 grew 102.4%, the FTSE 100 declined -3.1%, gold recorded 40.1% growth and crude oil 33.2%. Burgundy wine investments represent significant value to investors as gains are generally exempt from Capital Gains Tax.

Over the five years to 31.12.2022 the Burgundy 150 grew 102.4%, the FTSE 100 declined -3.1%, gold recorded 40.1% growth and crude oil 33.2%. Burgundy wine investments represent significant value to investors as gains are generally exempt from Capital Gains Tax.

Supply and the 2021 Burgundy vintage

- Scarcity is key - average yield reduced by over 50%

- Neal Martin: 'there are gems to find .... but you may have to re-mortgage your house'

- Demand for Burgundy wine investment is driving NFTs and other developments

Remember that scarcity is the key driver. An additional important factor in the region’s wines’ performance in 2022 was the knowledge that the 2021 vintage due to be released in January 2023, was tiny. Devasting frosts in Spring and searing summer temperatures in 2021 cut yields by 50% to 70% on average years.

Remember that scarcity is the key driver. An additional important factor in the region’s wines’ performance in 2022 was the knowledge that the 2021 vintage due to be released in January 2023, was tiny. Devasting frosts in Spring and searing summer temperatures in 2021 cut yields by 50% to 70% on average years.

So, an extremely scarce vintage with wines that Neal Martin observes “magically transcend the season… there are gems to find.’ ‘It’s just that you might not be able to buy them, and if you can, you might have to re-mortgage the house.’

This anticipation of even greater scarcity in the market led Burgundy buyers to new opportunities. NFTs were launched off the back of the fact that Burgundy was outperforming equities and most traditional assets spectacularly in 2021 to 2022.

Burgundy investment market and new Negociant labels

Another development has been the rise of Negociant labels in response to market demand. Domaine Arnoux Lachaux has been outstanding and one of the top stars of the 2022 Power 100. On average, the price of its wines have grown 487.2% with certain ones up around 1000% in the year. Its negociant label, Charles Lachaux offered a lower entry point to a high demand producer and has seen increased take-up.

Domaine wines are restricted by the ownership of Grand Cru and Premier Cru vineyard plots. Negociant wines can use fruit from where they wish to source it and release in their name. This is an important differential for investors as Village wines gain traction on the secondary market. The total trade of Village wines increased 68.3% between 2021 to 2022, whilst Grands Crus rose just 9.4% with UK Buyers the most significant driver of this. Given the fundamentals are the current higher values for Negociant wines sustainable?

Top five Burgundy brands by Average Trade Price in 2022

Rank | Burgundy wine | Av. Trade price |

1 | Domaine de la Romanée Conti | £75,435 |

2 | D’Auvenay | £75,435 |

3 | Georges Roumier | £19,661 |

4 | Armand Rousseau | £18,848 |

5 | Coche-Dury | £10,194 |

Source: Liv-ex Power 100 Report, 2022

Our view on investing in Burgundy in early 2023

Growth in demand and prices raced in the first half of 2022 as traditional markets became increasingly volatile. As we approached the end of the year there was a subtle softening in prices and, despite the Liv-ex Burgundy 150 index recording a -1.5% decline across November and December, it still ended 2022 the regional top performer.

Prices for some Burgundies may have reached a plateau and questions are being asked about short term sustainability. The Burgundy 150 recorded 0.4% growth in January 2023 and back in positive trend as equities rallied.

Investors should also consider liquidity - the other side of the double-edged sword, scarcity drives strong growth, but it can also reduce the number of buyers in the market for certain wines. This is not perhaps important if you’re in for the longer term and that really is where the value lies.

Burgundy’s 2021 vintage is reputedly 50% smaller than normal and has been released into the market at prices up an average 25%. Allocations have still sold out, but it is being described by Liv-ex as a vintage for the few not the many. What impression is that having right now? Investors are looking at older Burgundy vintages that still offer some scope for growth – but look carefully.

The likelihood of further pressures on supply in the future, as a result of climate change and continued growth in demand, would suggest that any short-term drift in prices would be resolved and could offer an opportunity for investors.

The world’s macro-economic challenges are not going to be resolved quickly and fine wine remains an attractive option to diversify investment portfolios with Burgundy still the top performer.

For more information on current market conditions and investment wine performance click below to get your copy of our latest Market Report. Alternatively speak to a member of our expert team on 0203 384 2262.