The home of the Grands Marques continues to deliver the top key regional five-year performance for investment wines. Should you be investing in prestige Champagne now?

Champagne’s ability to deliver sparkling growth

The Liv-ex Champagne 50 benchmark rose 94% between April 2020 and October 2022, during the fine wine bull-run induced by the pandemic and commencement of the Ukraine war. This explosive growth was aided by the launch of the outstanding 2008 Champagne vintage. To put some context to this effervescent performance, the Liv-ex Bordeaux 500 grew 25% in the same period.

In a recent interview Justin Gibbs, co-founder of Liv-ex, the fine wine market ‘stock-exchange’, commented that “The 2008s were just hitting the market and there was a lot of good press around Champagne at the time, so it flew”.

For example, Krug 2008 was released in October 2021, in the explosive period of growth in the sector, and saw its price double in its first year of trading on the secondary market.

Top traded Champagne 2019 – 2024

| Rank | Top traded Champagne by value | Top traded Champagne by volume |

|---|---|---|

| 1 | Louis Roederer, Cristal 2015 | Dom Perignon 2013 |

| 2 | Dom Perignon 2013 | Louis Roederer, Cristal, 2015 |

| 3 | Louis Roederer, Cristal 2014 | Taittinger Comtes de Champagne, Blanc de Blancs 2012 |

| 4 | Taittinger Comtes de Champagne, Blanc de Blancs 2012 | Louis Roederer, Cristal 2014 |

| 5 | Louis Roederer, Cristal 2008 | Ruinart Blanc de Blancs NV |

| 6 | Dom Perignon 2008 | Perrier Jouet, Belle Epoque 2014 |

| 7 | Bollinger, RD 2008 | Dom Perignon 2008 |

| 8 | Krug 2008 | Bollinger La Grande Année 2014 |

| 9 | Dom Perignon 2012 | Dom Perignon 2012 |

| 10 | Perrier Jouet, Belle Epoque 2014 | Bollinger, RD 2008 |

Source: Liv-ex.com, June 2024

The value of Champagne investment

Gibbs went onto say that “Champagne was undervalued before the pandemic, then it got over-valued. Now it’s back to being correctly valued again.” The facts are that rising interest rates and shrinking disposable income fuelled the price correction and forced a decline of 25% in the Liv-ex Champagne 50 since the October 2022 market peak as prices became more volatile.

Traditionally, Champagne has been the most stable, low-risk region in terms of price performance, delivering a solid return on investment. This dynamic is largely helped by the much larger volume of Champagne supply compared to the Bordeaux First Growths and Burgundy Grand Crus.

Traditionally, Champagne has been the most stable, low-risk region in terms of price performance, delivering a solid return on investment. This dynamic is largely helped by the much larger volume of Champagne supply compared to the Bordeaux First Growths and Burgundy Grand Crus.

Prestige, investment-grade Champagne provides good value when compared with the top wines of other regions. The Grands Marques are the ‘first growth’ equivalents of the region and prices for these can be as accessible as £150 a bottle (75cl). In contrast, Bordeaux equivalents command around £400 and Burgundy could be in the thousands. This makes Champagne highly accessible for most investors.

Rosé Champagne continues to command a premium as it’s available in a much smaller supply. For example, Louis Roederer Cristal 2008 was released at £1,900 (12 x 75cl), whereas the Rosé launched at £5,000.

Investment-grade Champagne supply

Market-leading investment wine producers in Champagne, such as Dom Perignon and Louis Roederer are creating more frequent vintage, investable, Champagnes. Previously, there were just a few made each decade. Certainly, global warming has helped make producing vintage Champagne easier.

Market-leading investment wine producers in Champagne, such as Dom Perignon and Louis Roederer are creating more frequent vintage, investable, Champagnes. Previously, there were just a few made each decade. Certainly, global warming has helped make producing vintage Champagne easier.

These more favourable conditions have meant that improving grape quality year-on-year has warranted more vintage Champagnes being made. Pol Roger announced, with the release of their 2018 vintage recently, that this was the first of a trio of potentially great vintages in a row.

Climate influence over Champagne

The ever-warming climate is also creating an increasing challenge for Champagne in the vineyards and the cellars. Rising temperatures and shrinking acidity levels in the all-important Pinot Noir grapes are seen as the greatest threat to the region. Well-resourced Champagne houses are developing different strategies to cope.

Severine Frerson, Cellar Master at Perrier-Jouët comments that “climate change is bringing new challenges, but through diligent grape monitoring we can have a precisely timed harvest, which ensures optimum maturity and a balanced sugar-acidity ratio in our grapes.”

Severine Frerson, Cellar Master at Perrier-Jouët comments that “climate change is bringing new challenges, but through diligent grape monitoring we can have a precisely timed harvest, which ensures optimum maturity and a balanced sugar-acidity ratio in our grapes.”

Emilien Boutillat comments for Piper-Heidsieck’s Rare, that they are using the technique of blocking malo-lactic fermentation in certain components of the blend to “preserve the minerality, freshness and ageing potential of our most recent blends.”

Growing demand for older Champagne

Producers are also having to adapt to the increasing demand for extra-aged Grandes Marques. This commercial pressure means winemakers need to protect the ageing potential of the region’s finest wines in the face of a warming climate.

Those houses with an extensive back-library are already responding. Louis Roederer launched a late-release vintage in 2022 of five wines going back to 1990 which were allowed to continue ageing in-cellar post disgorgement. They have also launched a quartet of late-release Rosés dating back to 1995 with the expectation these will age for 30 years.

Pol Roger is launching six vinotheque wines to feature in the original black label to celebrate their 175th year in September 2024, which will include 1998 and 1999 vintages.

Current Champagne investment activity

Trade in Champagne picked up in the first week of June 2024, as the Bordeaux 2023 En Primeur campaign drew to a close. The region saw a spike in trade, accounting for 17.2% of the total trade value on Liv-ex. Three of the top-five traded wines by value were Champagne investment wines and Dom Perignon 2013 and Cristal 2015 were also the top two traded by volume.

Top five traded investment wines on Liv-ex in week 1 June 2024

| Top wines traded by value | Region | Liv-ex mid-price |

|---|---|---|

| Louis Roederer, Cristal 2015 | Champagne | £1,842 |

| Sassicaia 2021 | Tuscany | £2,800 |

| Dom Perignon 2013 | Champagne | £1,552 |

| Domaine de la Romanée Conti La Tache 2021 | Burgundy | £41,664 |

| Salon Le Mesnil Grand Cru 2013 | Champagne | £8,520 |

Source: Liv-ex.com 7th June 2024.

Our view on investing in Champagne

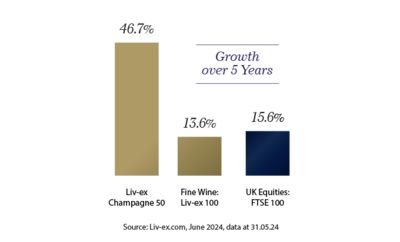

Champagne is still the best-performing wine investment region over five years. The last two years have seen average prices adjust downward by -16% to the 31st May 2024. Year-to-date, Champagne prices have slipped -4%. The trajectory of the price softening is lowering significantly. April saw a -0.9% dip and in May the average was -0.2%. Market experts such as Justin Gibbs believe that Champagne prices correctly reflect value currently and the ‘heat’ has been taken out of the market.

The craftsmanship, increasing rarity and ageing potential of the great Champagnes will always find willing buyers. The brand power of the Grandes Marques is a major factor with take-up in growth economies such as the UAE and Asia creating vibrant markets for Champagne. Historic and current trade volume shows that there is demand for these wines across the world.

The craftsmanship, increasing rarity and ageing potential of the great Champagnes will always find willing buyers. The brand power of the Grandes Marques is a major factor with take-up in growth economies such as the UAE and Asia creating vibrant markets for Champagne. Historic and current trade volume shows that there is demand for these wines across the world.

We recommend that all wine investors have a Champagne component in a well-rounded fine wine portfolio and there are currently significant opportunities in the market.

For more information speak to a member of our expert team on 0203 384 2262 and download our latest Market Report.