US buyers can spend without a tariff hit in the 2024 En Primeur Campaign deferring Trump’s import levy.

We are days away from the launch of the Bordeaux 2024 vintage and the trade tastings due to take place at the region’s chateaux and with key negociants. The background to this year’s campaign has been radically changed by Trump’s Tariffs agenda.

As I predicted recently in my interview with Drinks Business, the levy imposed on EU imports to the US is well short of the 200% threatened, but the 20% levy, topping up the 10% already in place, has already put the brakes on the shipping of some products frm Europe to the US.

What has been the impact on the fine wine market?

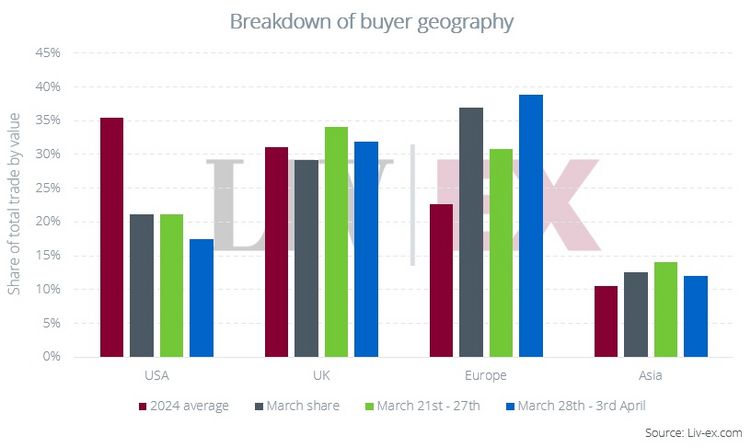

Liv-ex reported that on the 2nd April, the immediate response to the tariff announcement was that ‘US buyers quickly pulled out of the market’. Overnight the value of US bid exposure on the exchange fell 86.9%. All parties are now waiting for clarity from the EU and their response. Unlike China, the EU is keen to avoid escalating a trade war and is sensitive to the importance of the wine industry to French and Italian economies particularly.

US demand has become a major driver in the secondary market and in 2024 accounted for 35.5% of the total purchase value on Liv-ex. Last year was the first where the US became the leading territory in terms of greatest trade share on the exchange. This buying power was boosted in 2024 and Q1 2025 by a stronger dollar, the advantageous prices and latterly, with Trump’s return to the White House, the threat of tariff action.

Bordeaux 2024 En Primeur – the Tariff Dodge for US buyers

With US importers of fine wine currently considering their options, Bordeaux 2024 futures are an opportunity not to be missed!

The fundamentals of acquiring wine at En Primeur stage means that the buyer secures their wine at first release to the market and their allocation of wine in-barrel will remain in the chateau cellar for at least two years, possibly longer. The wine is then bottled and can remain stored in bonded warehouses until shipped, avoiding an import tariff for years. It is highly likely that the current tariff actions will be resolved in this maturation period.

Combine this factor with the current state of the fine wine market where prices have corrected back to levels before the pandemic bull run with iconic wines at the lowest prices for years. It’s a significant opportunity for US buyers to avoid tariffs and take advantage of a likely well-discounted release campaign.

Bordeaux 2024 En Primeur priced right

Key market players view the release of the Bordeaux 2024 vintage at the right price as having the potential to reinvigorate the En Primeur system and be the catalyst to ending the current market malaise.

Analysts and major supply chain stakeholders have clearly expressed how important it is that the chateaux and their advisors get the pricing strategy right on this vintage release. They must price at a level that engages and benefits the whole supply chain, from the negociants through to the end consumers.

Analysts and major supply chain stakeholders have clearly expressed how important it is that the chateaux and their advisors get the pricing strategy right on this vintage release. They must price at a level that engages and benefits the whole supply chain, from the negociants through to the end consumers.

This fundamental requirement for the industry is a significant opportunity for US buyers and those of other regions. The timing to buy in En Primeur wines could be perfect for US investors in the 2024 campaign.

What does this mean for investors outside the US?

There are currently significant opportunities in the fine wine secondary market for investors to position for future growth. The conditions may be enhanced in the short-term as stockholders seek out replacements for US buyers.

Should US buyers withdraw from the market for a period, there will need to be a significant readjustment in the international demand vs supply balance. Given that current prices are at market lows for many wines, the conditions are favourable to attract new customers and open new markets outside the US.

The Bordeaux 2024 En Primeur campaign is potentially a very significant opportunity for investors, wherever located due to the factors influencing the market currently and the genuine need for the chateaux and negociants to re-engage the whole supply chain in the En Primeur process. This vintage is also a lower supply year and, priced right, the very best wines could be important acquisitions for future growth.

As financial markets continue to be extremely unpredictable investors need to work out how and where to protect their hard-earned capital. Fine wine is a valuable, tax-efficient, stable asset to diversify your portfolio into.

As financial markets continue to be extremely unpredictable investors need to work out how and where to protect their hard-earned capital. Fine wine is a valuable, tax-efficient, stable asset to diversify your portfolio into.

Vin-X is a trusted provider of wine investment services, and our expert team is here to help you take advantage of the opportunities and plan for risk. Our specialist team are attending the Bordeaux 2024 tastings at the chateaux this month and we will be publishing our view on the vintage.

To discover more, see our Guide to investing in fine wine and contact our expert team to register your interest in the 2024 campaign.