Liquid gold, literally, fine wine investments are delivering returns that are protecting capital and shoring up investment portfolios.

The ONS announced on Armistice Day that the UK economy shrank -0.2% in the quarter July to September 2022 and that the country is forecast to be in recession in Q4. What’s not clear now is how long, nor how deep. The key drivers of the war in Ukraine, energy costs and political and economic turbulence around the world are not quick fixes. We are looking at an extremely challenging period for all.

Where are the safe-haven investments?

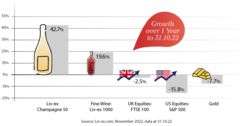

Safe-haven assets and traditional inflation hedges such as gold aren’t acting true to form in the current economic environment. Gold has seen an average fall of -10.7% in 2022 to the end of October and -7.7% in the last year. This has been largely due to a stronger dollar, which has been seen as a safer currency bet with unpredictable markets. Sterling’s positive trajectory against the dollar in October did not trigger a boon for gold prices as it declined -2.9% in the month, contra to the rally in equities.

Fine wine, meanwhile, responded to Sterling’s moves with a more modest 0.2% market average in October down from 2.1% trend in September. This was partly due to the window closing on a bargain period for USdollar buyers, during Sterling’s challenges brought on by Liz Truss’ mini-budget fiasco.

Which investment wines are driving the market?

Champagne and Burgundy are driving the larger gains and with average growth of 28.5% and 24.8% respectively so far in 2022 it’s not hard to see why they are adding sparkle to portfolios.

Accessibility, performance and the opportunity to test the water with a relatively modest sum is one of the key attractions of Champagne. You can acquire a case of investment-grade Champagne for less than £2,000 and enjoy average 12-month growth around 40% if the current trend continues. In October 2022 a case of Pol Roger Winston Churchill 2012 acquired at the start of the month for £1,839 (trade price Liv-ex) grew 14.2% to £2,100 at the month-end.

Louis Roederer Cristal is arguably the most powerful Champagne brand in 2022, being one of the most traded labels by volume and value. When you look at the entry point and returns, you can see why. Cristal 2008 was first released onto the market in 2018, its value has grown 110.5% since then, from £1,900 to £4,000 (12 x 75cl).

How do tangible assets wine and property compare?

The general trend for fine wine assets is growth just under 20% in the last 12 months (Liv-ex 1000 benchmark at 31.10.2022). In the same period UK property has seen average growth of 8.3% (Halifax, 31.10.2022) and the housing market is seeing a notable slowing in growth. The challenges for property investors are becoming increasingly complex, with more interest rate rises on the cards, the buy-to-let market is looking particularly vulnerable.

Savers may finally be seeing the tiniest upside to the rising interest rates, but the investment landscape remains unpredictable and savvy investors are diversifying their portfolios to manage risk and hedge inflation.

Despite rising inflation and interest rates, volatile financial markets and political turbulence, fine wines are still seeing growth and delivering value to investors. For more information see our latest Wine Investment Market Report and contact us on 0203 384 2262