Can the most famous investor in the world’s investment strategy apply to fine wine in 2024?

Warren Buffet is probably the best-known investor in the world and has achieved this accolade by sticking to certain simple rules for buying and holding investments in his portfolio. Can they be used by wine investors?

1.‘Never lose money’ [in something you don’t understand]

Warren urges investors to be informed and to take the time to learn about a market and the assets within it, the performance trends and the risks, before acting. In his words – “risk comes from not knowing what you are doing”.

Fine wine has been created, consumed and traded for centuries, and merchants and their clients have acquired fine wine to sell later at a profit. So, it’s not a new market to get your head around. The advent of the internet facilitated a significant stride forward for the wine investment market. Liv-ex, the fine wine exchange, was created in 1999, providing greater price transparency, trading efficiency, market analysis and data.

As Warren points out, information is key and wine investors in the 21st Century have plenty of opportunities to learn about this rewarding market from various specialist platforms and to be guided by a growing number of expert brokers and merchants.

2. Buy undervalued stocks with solid long-term potential

The essence of Buffet’s investing principles is to ‘Buy undervalued stocks with solid long-term potential’. The fine wine market in H2 2024 offers a golden opportunity to act on this rule.

The market conditions this year are well documented. The fine wine sector has undergone a period of marked price adjustment since the previous peak in October 2022.

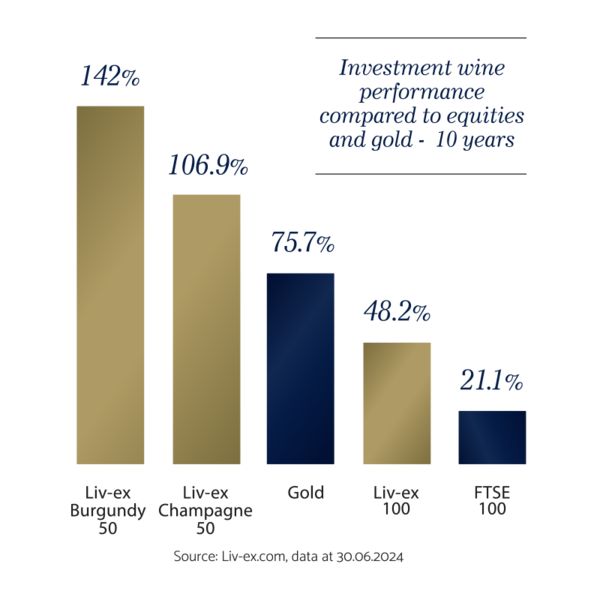

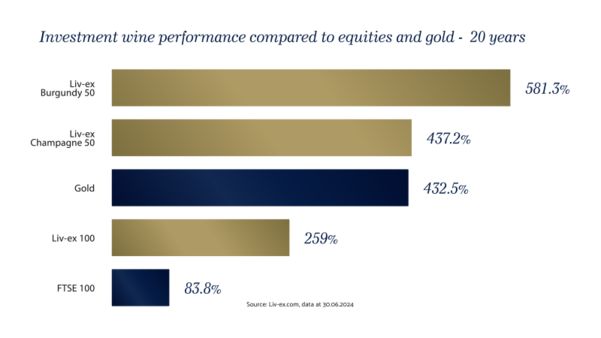

The Liv-ex 1000 index is the broadest market measure and recorded an average correction of -18.6% over the 2 years to the end of July 2024. Even with this downward pressure on prices fine wine outperforms equities in the long term.

In Autumn 2024, investment wines could easily be described as ‘under value with proven long term potential’. Iconic labels and key vintages from Bordeaux, Burgundy, Champagne, Italy and California are currently available at lower prices and with proven track records of delivering strong returns over the long term.

Liv-ex data in the charts above shows the data at the end of H1 2024 and that over ten and twenty year periods fine wine out-performs equities, gold and other commodities. These results are with wine prices at the market low at 30th June 2024, further discounts are available in Q3.

3. Research an investment and remain committed

Warren Buffet is the ultimate exponent of ‘buy-and-hold’ philosophy. He explains that being committing to a long-term hold keeps an investor from ‘acting too human’. Being fearful or greedy can cause investors to sell at the market bottom or buy at the peak and destroy portfolio appreciation in the long run.

The legendary investor is famous for the level of research he undertakes to establish a fair price for a particular stock. The rest of the market may be in a panic-selling mode, but he sees opportunities as prices fall.

Warren adds to a holding when value drops to an attractive price level even during extreme volatility. He will also sell and take profit when prices exceed a reasonable level. He argues that investors should hold through thick and thin and ignore volatility unless there are material changes in an investment’s outlook, e.g. product obsolescence.

Warren adds to a holding when value drops to an attractive price level even during extreme volatility. He will also sell and take profit when prices exceed a reasonable level. He argues that investors should hold through thick and thin and ignore volatility unless there are material changes in an investment’s outlook, e.g. product obsolescence.

Fine wine's asset characterisitics of improving quality and increasing rarity over time supports strong and stable growth over longer investment periods.

Our view on investing in wine in H2 2024

Investors in fine wine can certainly apply Warren’s rules to this rewarding market and, as an asset, wine delivers the long term returns he looks for in an investment.

Certain sectors of the fine wine market are at or near their ‘market bottom’ based on prices in Q3 2024 and on performance and regional trends over the last five years. Within that period, we have seen the market experience a bull-run that drove values to surge to beyond a sustainable level. Individual wines achieved triple-digit growth and were then vulnerable to the market correction that has followed.

Investors following Warren’s rules may have taken profit during the months leading up to 31st October 2022 and are buying in 2024 as prices have reached the current market lows.

There is a strong case that the remaining months of this year could be that golden moment for investors in fine wine to add to their portfolios or to enter the market for the first time and position for future growth.

See Vin-X’s Guide to Investing in Fine Wine for more information on the market fundamentals and benefits for investors, and speak to our expert team on 0203 384 2262.