Fine wine is giving investors plenty to celebrate on National Wine Day 2022. We look at five key reasons to add wine to your investment portfolio.

1. Performance

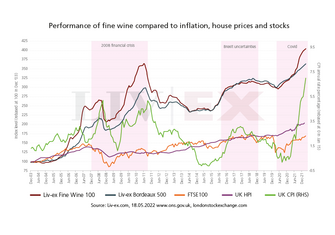

In 2022, fine wine is delivering stronger returns to investors than UK property, equities and cryptocurrency. As a norm, investment wines enjoy stable growth over the long-term, with performance that is not directly correlated to financial markets. As the secondary market in fine wines has matured, from being Bordeaux-centric and primarily focused on the First Growths, to become broadly diversified into the most valuable and highly sought-after wines from Burgundy, Champagne, Italy, Napa and a few from Spain and Australia, it has become more resilient with investor demand driving strong short-term growth in certain wines.

Burgundy and Champagne wine investments are experiencing significant growth in the market with the Liv-ex Burgundy150 index recording average regional price growth of 18.6% YTD to 30th April 2022.

The sparkling regional top price performer over the last 12 months, Liv-ex's Champagne 50 index has recorded an average 50.6% growth over the last year. The region's outstanding 2008 vintage is delivering some astounding returns to investors, with top performer Jacques Selosse’s Millesime 2008 rising 346% in 12 months from £8,208 to £36,648 (Liv-ex trade price, May 2022).

2.Tax efficient

Profits from fine wine investments are generally free from Capital Gains Tax. This is, of course, subject to an individual investor’s personal circumstances, but like a number of luxury investments, with a life expectancy of no more than fifty years, the advantageous tax treatment of fine wine is one of its attractions to investors. A fuller explanation of tax and fine wine is provided in our specialist Tax Report.

3. Tangible

Investment wine is a ‘real’ asset with finite supply. It’s not a share which can lose huge value in a day, or be written off. Wine is a tangible investment that has inherent value. Prices rise as fine wine matures, improves and becomes rarer over time.

4. Liquidity

The secondary market in fine wine is well established and with the advent of the internet and platforms like Liv-ex providing price transparency and performance data, is increasingly efficient. There are clear routes to market for investors with specialist wine investment companies providing expert guidance on fine wine as an alternative asset to be included in financial planning. Investment wines can generally be bought and sold in line with an investor’s preferred time frame, and owners are not reliant on auctions to realise their investments.

5. Hedge against rising inflation

Wine investments are used to protect capital in periods of economic uncertainty and stress. As global inflation rises to levels not seen for forty years investment wines are growing in value as financial markets and shares experience increasing volatility and losses. Fine wine can be used as a diversification tool when planning your portfolio to introduce stability and growth to hedge more unpredictable assets, such as equities and cryptocurrency.

Investing in fine wine is becoming better understood by investors as an important component of a well-balanced and robust portfolio. Find out more about the benefits of investing in fine wine and speak to a member of our team on 0203 384 2262.