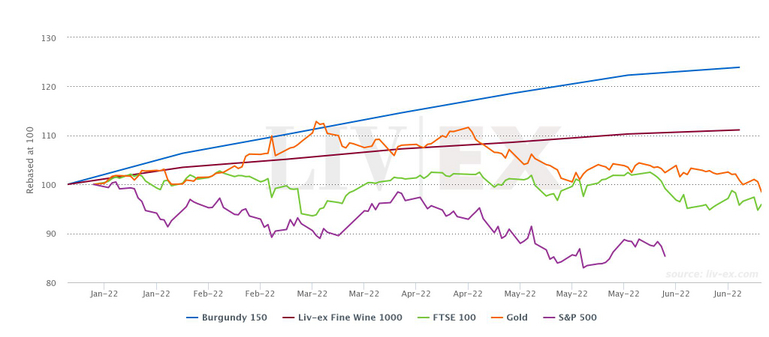

It’s official, 2022’s first half year results are the worst for 50 years in developed market equities. Wine investments maintain growth as volatility and unpredictability grows.

First-half 2022 market headlines:

- World stock markets have recorded their worst first half year results in decades

- MSCI World Equity index has lost US$13bn value in first 6 months of 2022

- US stocks have recorded their worst H1 in over 50 years

- Government bonds have had the largest H1 decline since 1788

- UK real household income has had its longest fall on record

- Rise in UK industrial action in transport, legal and telecoms sectors

- Fine wine bucks the trend with average 11.1% gains in first 6 months of 2022

It makes for scary reading; the US S&P500 index saw a fifth of its value eradicated in the first six months of 2022, with its fall of 20.6% the steepest first half-year decline since 1970. The tech-heavy Nasdaq endured its largest ever January-to-June fall of 29.5%, and the Dow Jones slumped 15%, its greatest H1 percentage fall since 1962.

The UK’s FTSE 100 has been the least affected of the key equity indices, largely because of its component oil and gas companies. In contrast the MSCI’s World Index has fallen 20% since the start of 2022 to the year’s mid-point, losing US$13trn of share value in its worst H1 performance since the index launch in 1990.

The strongest commodities rally since World War 1, boosted by Russia’s invasion of Ukraine, has markets reeling and is contributing to rising inflation, now at the highest level in decades.

It doesn’t end there, 10-year US Treasury Bonds are the benchmark for global borrowing markets and a ‘go-to-asset’ for institutional investors in challenging economic periods - they have had their worst H1 performance since 1788.

‘New-age’ investors have sought refuge from rising inflation in the Crypto-market, which at the end of June 2022, has been described as in a state of ‘widespread carnage’. Gold, the traditional safe-haven asset is struggling to maintain positive territory in 2022, its YTD performance at the end of June was at -0.7% negative.

Central banks, meanwhile, are having to bring out the fiscal big guns to address rising global inflation and are planning to proceed with the most aggressive synchronised tightening schedule since the 1990s. Markets are expecting interest rates to rise to 3.4% in the US, 3% in the UK and 1.6% in Europe by 2023 and it is these forecasts that are creating real concern about economic growth this year and value loss in equities.

Volatility in global markets, the downturn in Government bonds, global inflation at the highest levels for over 40 years and rising fears of recession are creating the perfect storm for investors. In contrast wine investments are staying stable and delivering returns to investors.

Wine investment in the first half of 2022:

- Fine wine investments saw an average growth of 11.1% (Liv-ex 1000)

- Burgundy investments led the market seeing an average 23.9% growth

- Average Champagne wine investments achieved 12.5% gains

- Champagne investments rose by an average 1.6% in June 2022

- Over the last year the Liv-ex 1000 has risen 25.5%, the Liv-ex Champagne 50 has risen 50.8% and the Liv-ex Burgundy 150 is up 50.3%.

Top performing wines in Q2, 2022

Individual investment wines are seeing significantly stronger growth than trend. Quarter 2 top price performers were led by Rhone’s M. Chapoutier Ermitage Le Pavillon 2014 which rose 48.2% and Burgundy’s Domaine Armand Rousseau Chambertin 2014 up 48.1%.

Top traded wines by value on Liv-ex in Q2 saw Louis Roederer Cristal 2008 and Screaming Eagle 2019 as the leaders. The most traded wines by volume were fronted by Super Tuscan Tignanelllo 2019 and Dom Perignon 2012. The wine investment market is diverse, transparent and liquid and has evolved significantly from the days of the 2008 financial crisis where it was Bordeaux centric. There are significant opportunities to invest in fine wine at a wide range of price points and it is no longer a market exclusive to the super-wealthy.

To protect capital and achieve growth in a period of extreme economic unpredictability, investors should be looking to diversify portfolios with assets like fine wine that tend to grow with inflation, are not directly correlated to financial markets, are stable, low-risk and tax-efficient.

For more information, see our latest Market Report and speak to a member of our specialist wine investment team on 0203 384 2262.