Italy’s consistently excellent quality investment wines are more affordable, offer diversification and are holding steady in 2024.

This is one of the reasons why Chris Robshaw and I chose to visit the region earlier this year. We were keen to learn more about how and why the regions wines are developing such a strong following, and how the winemakers are adapting to changes in climate but continuing to develop outstanding wine.

We were fortunate enough to be invited to Ornellaia in Bolgheri, Tuscany. Watch our video to get some spectacular insight on this key estate and investing in Italy's wine assets.

Five reasons to invest in Italian wines

- Performance – The Liv-ex Italy 100 index is the top performing regional index YTD, over 1 and 2 years and second to Champagne over 5.

- Stability – There is a growing market share and liquidity particularly in the Super Tuscans.

- Ageing potential – The very best Piedmont and Tuscan wines are similar to the great Bordeaux and Burgundy brands.

- Diversification – The value of including Italian investment wines is evidenced by their stronger performance in current market conditions compared to price suppression experienced by Burgundy and Champagne labels.

- Affordability - The region’s leading wines achieve similar quality scores to Bordeaux First Growths and Burgundy Grand Crus but are priced for value.

The current market conditions for Italy’s investment wines

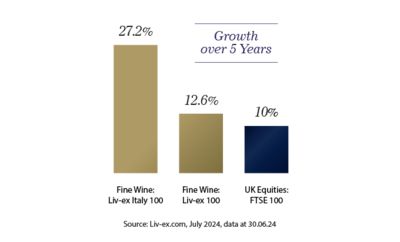

The Liv-ex Italy 100 index has grown 27.2% in the last five years and has been the exchange’s most stable regional benchmark in the 12 months to 30th June 2024, performing well ahead of the general trend. The index slipped just -2.1% in the first half of the year compared to the Liv-ex 1000 -6.3%. In June, Italy accounted for 12.9% of trade value on the exchange with Tuscany responsible for 9.1% and Piedmont 3.8%.

The Liv-ex Italy 100 index has grown 27.2% in the last five years and has been the exchange’s most stable regional benchmark in the 12 months to 30th June 2024, performing well ahead of the general trend. The index slipped just -2.1% in the first half of the year compared to the Liv-ex 1000 -6.3%. In June, Italy accounted for 12.9% of trade value on the exchange with Tuscany responsible for 9.1% and Piedmont 3.8%.

Liv-ex reported in June 2024 that the Super Tuscan index had risen 0.5% YTD to 31st May 2024, outperforming all of the regional indices.

Over the last 12 months, two years and shorter term the Liv-ex Italy 100 is the top performing regional index at the end of June 2024.

The origins of Italian investment wines

Italy is one of the top three most prolific wine producing countries in the world with a vine-growing history that dates to the 8th Century. However, the creation of Italian fine wine is relatively recent with Tuscany and Piedmont driving the development over the last 40 years.

The great dynasties of Frescobaldi, owners of Masseto and Ornellaia, Antinori who own Tignanello and Solaia, and the Marchesi Incisa della Rochetta of Tenuta San Guido (Sassicaia) have led viticultural change to create excellence to rival Bordeaux and Burgundy’s top wines. All with histories spanning hundreds of years and generations of ownership of the most prized vineyards in Italy, they have engineered the evolution of Italy’s fine wine industry.

The great dynasties of Frescobaldi, owners of Masseto and Ornellaia, Antinori who own Tignanello and Solaia, and the Marchesi Incisa della Rochetta of Tenuta San Guido (Sassicaia) have led viticultural change to create excellence to rival Bordeaux and Burgundy’s top wines. All with histories spanning hundreds of years and generations of ownership of the most prized vineyards in Italy, they have engineered the evolution of Italy’s fine wine industry.

These great Tuscan estate owners were the first to introduce Bordeaux varietals Cabernet - Sauvignon and Franc - and Merlot grapes along with the use of barriques to Italy, advancing the aging potential of their wines. The adoption of single vineyard labels was also a key development to improve quality and enhance the brand profile of the key Italian investment wines.

There have been challenges along the way. The use of the Bordeaux varietals meant the wines did not meet the Italian DOC/DOCG strict conventions, and so they were initially categorised as Vina da Table, Italy’s lowest quality tier! But this did not last long. At a blind tasting in 1978 a Sassicaia wine outscored a top Bordeaux by international critics. It became apparent that these wines needed to be distinguished from Toscana IGT and so – The Super Tuscans were born.

An introduction to the Super Tuscans

The Super Tuscan’s relative higher production levels, compared to Piedmont wines, deliver liquidity and price performance, fuelling an active secondary market with Sassicaia often ranked in the most traded by value and volume on Liv-ex. These wines have steadily grown in popularity with investors and collectors, supporting rising price growth.

There is a very clear understanding by the estates of the value of their wines and their appeal as investment assets. Masseto went so far as to describe itself as “a parachute for investors in times of crisis” in 2008.They provide investors with a lower entry point into the fine wine market and are generally affordable alternatives to First Growths, except for Masseto whose greater scarcity supports a price performance akin to its Piedmont equivalents.

There is a very clear understanding by the estates of the value of their wines and their appeal as investment assets. Masseto went so far as to describe itself as “a parachute for investors in times of crisis” in 2008.They provide investors with a lower entry point into the fine wine market and are generally affordable alternatives to First Growths, except for Masseto whose greater scarcity supports a price performance akin to its Piedmont equivalents.

The Best Super Tuscan Wines

| Wine | Owner | Grape | Key facts |

|---|---|---|---|

| Masseto | Frescobaldi family President – Lamberto Frescobaldi | Merlot |

|

| Ornellaia | Frescobaldi family President – Marchese Ferdinando Frescobaldi | Cabernet Sauvignon Merlot Cabernet Franc Petit Verdot |

|

| Tenuta San Guido Sassicaia | Marchesi Incisa delle Rochetta Honorary President: Nicolo Incisa Managed by third generation five cousins | Cabernet Sauvignon |

|

| Solaia | Marchesi Antinori Tenuta Tiganello vineyard | Sangiovese Cabernet Sauvignon Merlot |

|

| Tignanello | Marchesi Antinori Tenuta Tiganello vineyard | Sangiovese Cabernet Sauvignon Merlot |

|

An introduction to Piedmont investment wines

Like Burgundy is to France, so Piedmont (or Piemonte) is to Italy. The top wines of the north are made in the highest quality but in very small supply. The Piedmont wines are typically made from the local Nebbiolo (Pinot Noir) grape, grown in tiny quantities in specialised vineyards.

The much scarcer supply of Piedmont wines is the reason for the much lower trading activity of tightly held stock on Liv-ex. However, the levels of trade are growing as buyers have become increasingly aware of the quality and rarity of the top wines of Northern Italy.

The much scarcer supply of Piedmont wines is the reason for the much lower trading activity of tightly held stock on Liv-ex. However, the levels of trade are growing as buyers have become increasingly aware of the quality and rarity of the top wines of Northern Italy.

Italy’s exemption from Trump’s increased Duty on European wine in 2019 opened both Piedmont and the Super Tuscans to US buyers and the top wines experienced significant growth but also grew their profile with this important trade sector. The UK remains a key market for Piedmont and Asia and the far East are also important, growing consumer bases.

Leading Piedmont Investment Wines

| Wine | Owner | Grape | Key facts |

|---|---|---|---|

| Giacomo Conterno Barolo Montfortino Riserva | Roberto Conterno | Nebbiolo Barbera |

|

| Bartolo Mascerello Barolo | Marie-Teresa Mascerello (since 2005) | Nebbiolo Barbera Dolcetto |

|

Bruno Giacosa Barbaresco Falletto DOCG Barbaresco Asili DOCG Barolo Le Rocche del Falletto DOCG | Daughters Bruna and Marina Giacosa (since 2006) | Nebbiolo |

|

| Gaja Barbaresco | Angelo Gaja Piedmont winery founded in 1859 by Giovanni Gaja Managed by Angelo’s children; Gaia, Rosanna and Giovanni | Nebbiolo |

|

Piedmont’s importance for wine investors grew in 2023 as lower supply provided some price protection during the challenging market conditions, making Italy the top performing region last year. Higher profile Super Tuscans saw some slip in average price but also achieved top ten rankings in trade. Sassicaia was ranked the 5th most powerful fine wine brand in 2023 by volume and 9th by value of trade on Liv-ex. Tignanello also saw an uptick in trade and was ranked 8th by volume of trade in the Power 100.

Liv-ex’s top ranked Italian investment wine brands

The annual Liv-ex Power 100 ranking of most powerful wine brands reported that 13 Italian producers made the top 100 in 2023. Gaja was the leading Italian label on the exchange last year, ranked 7th.

Italy’s Top 10 most powerful wine brands

| Brand | Region | Ranking | Average Trade Price | Average Growth |

|---|---|---|---|---|

| Gaja | Piedmont | 7 | £1,702 | 2.33% |

| Giuseppe Rinaldi | Piedmont | 15 | £1,924 | 5.67% |

| Tignanello | Super Tuscan | 20 | £1,216 | 3.07% |

| Giacomo Conterno | Piedmont | 27 | £4,208 | -2.49% |

| Ornellaia | Super Tuscan | 34 | £1,451 | -0.28% |

| Biondi-Santi | Tuscany | 35 | £1,916 | 2.5% |

| Bruno Giacosa | Piedmont | 44 | £2,312 | -2.86% |

| Roagna | Piedmont | 46 | £1,551 | 5.69% |

| San Guido Sassicaia | Super Tuscan | 57 | £1,828 | -4.45% |

| Vietti | Piedmont | 62 | £1,429 | -2.33% |

| Masseto | Super Tuscan | 73 | £6,860 | -4.63% |

Italian investment wine performance in 2024

Italy has been the most stable region for fine wine performance over the last 12 months, drifting just -4.8% to the end of June 2024.

In the shorter term, the Liv-ex Italy 100 benchmark recorded the smallest movement of -2.1% in H1 2024, a notable uplift on the broader trend measured by the Liv-ex 1000 of -6.3%.

Liv-ex reviewed Italian investment wines performance in May 2024 and revealed the top performers mid-way through Q2.

Top 5 Italian investment wines - May 2024

| Wine | Vintage | Region | Growth in May 2024 |

|---|---|---|---|

| Giacomo Conterno Barolo, Monfortino Riserva | 2008 | Piedmont | 7.6% |

| Solaia | 2015 | Super Tuscan | 7.1% |

| Bartolo Mascarello, Barolo | 2016 | Piedmont | 5.6% |

| Tignanello | 2020 | Super Tuscan | 5% |

| Ornellaia | 2015 | Super Tuscan | 4.1% |

Our view on investing in Italy’s fine wines

Italy offers significant benefits to wine investors as listed above in the reasons to invest. The average lower prices for excellent Italian wines, rated by the top critics as being equivalent in quality to Bordeaux First Growths ,opens the market up to investors for whom Bordeaux icons are not yet affordable.

Critical acclaim by a growing number of fine wine experts now seriously looking at Italy is bringing a greater appreciation for the wines of Piedmont and Tuscany, and more buyers into their sphere. As a result, there is more trade in Italian labels on the secondary market.

Critical acclaim by a growing number of fine wine experts now seriously looking at Italy is bringing a greater appreciation for the wines of Piedmont and Tuscany, and more buyers into their sphere. As a result, there is more trade in Italian labels on the secondary market.

Diversification with Italian wines offers significant benefits for wine investors and this has been illustrated during the market correction since October 2022. Italy’s investment wines managed to maintain more sustainable price growth during the ‘bull-run’ and delivered a more robust performance than Burgundy and Champagne over the correction period.

A key factor for the future of Italian investment wines is climate change. Italy’s viticulture industry is at the fore-front of the challenges now being faced as the conditions become increasingly difficult for wine growers. This could mean lower productivity, a change in grape types or the inability to grow vines in some areas. The current wines could be some of the last of their current guise if solutions aren’t sought quickly enough.

Finally, an increasing number of Italian estates are launching their wines via the Place de Bordeaux, improving their route to and activity on the secondary market. This will all add to the energy in this sector. An attention-grabbing sale illustrating the growing collectability hit the press in July 2024 with the first launch of Tuscan's Bibi Graetz wine onto the Place. A 27-litre bottle of Colore 2016 which went for a record-breaking 100,000 Swiss Francs (£86,943)!

With all of the above in mind we strongly support adding key Italian wines to diversify and strengthen a fine wine portfolio. There has been sufficient price pressure recently to allow investors to acquire some of the top wines at a level that delivers strong potential for future growth.

For more information, speak to a member of our expert team on 0203 384 2262.