Happy New Year! 2025 is up and running – what can investors learn from 2024, which key factors will shape the market and how can they make the most of opportunities?

We are looking forward to an exciting period ahead for wine investors. There are many factors to consider as we appraise the market at the start of this year, not least the advent of Trump 2.0.

Investors looking to add growth to an investment portfolio must consider the significant opportunities fine wine offers in Q1 2025.

Investors looking to add growth to an investment portfolio must consider the significant opportunities fine wine offers in Q1 2025.

But before I provide my insight on investing in wine this year, it’s worth noting the key events of 2024 that will influence buying decisions, performance, and opportunities in the coming months.

2024 events that will shape the market in Q1 2025

- The year-end marked a sustained period of 25 months of sector price correction with a return to positivity for the key Liv-ex 100 benchmark rising 0.2% as the FTSE 100 fell -1.4%.

- Increasing volatility in the key wine benchmarks in H2 2024 reflected the shift in momentum with increasing numbers of wines recording price stabilisation and growth.

- A notable rise in the number of market participants and transactions on Liv-ex in Q3 and Q4 with trade count 5.5% higher than 2023.

- Record levels of trade on Liv-ex in September, October and November as sellers finally succumbed to pressure and softening prices boosted buying.

- The festive break impacted trade value by just 4% in December as demand for higher value wines rose.

- US buyers have become a significant force in the global fine wine market accounting for 34.8% of all trade YTD on Liv-ex at the end of November 2024 and 50% of trade over the Festive period (full year data to follow).

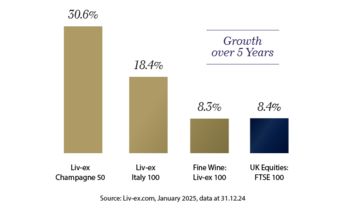

- Champagne was the top performing region for longer term performance value on 2024 with the Liv-ex Champagne 50 rising 30.6% in the five years to 31st December 2024. This performance is three times stronger than the FTSE 100’s 9.9% over that period.

- Discounted Champagne attracted increased buyers with Grand Marques trading in significant volume and value in Q3 and Q4 2024. This boosted price growth in key labels such as Louis Roederer Cristal, Dom Perignon and Bollinger. Investors took advantage of market lowest prices for some with Cristal 2015 a target.

- Italy’s fine wine price performance, (Liv-Ex Italy 100 index), was the most robust over one year with the number of transactions in Italian fine wine rising over 17% year-on-year with volume up 17.3% and value rising 9.8% in 2024 on 2023 levels.

- Spain’s key vineyards are an emerging area of interest for investors with Vega Sicilia Unico a key success story last year and ranked first in Liv-ex’s Power 100 2024.

- Bordeaux is still the most prolific fine wine region, providing liquidity and accounting for a third (33.3%) of trade on Liv-ex by value in December 2024.

Factors to drive change in 2025

The data at the start of 2025, suggests that the ‘only way is up’! The market trend in Q4 last year and early January has been to see further demand and some uplift in prices for wines viewed as highly opportunistic for growth.

However, wine investors need to consider all the factors that will impact performance this year and some are significant:

However, wine investors need to consider all the factors that will impact performance this year and some are significant:

- Trump 2.0 and potential tariffs

- Inflation – global and domestic

- Geo-politics and market uncertainty across all assets

- Climate change and increasing impact on productivity, supply and quality

- En Primeur release pricing particularly for Bordeaux; levels need to reflect the market conditions

- Tax regime changes that come into force in the UK in Spring 2025 further enhance fine wine’s appeal to investors.

Fine wine, like other markets, will see conditions change and prices evolve, but key fundamentals support long-term price growth.

Wine Investment Fundamentals

- Finite supply which reduces over time as wine is consumed

- Investment wine quality improves with age as it evolves in bottle and becomes rarer

- Tangible asset with ‘real value’

- Performance is not directly correlated to financial markets

- Regional, vintage and brand diversification will optimise returns

- Profits made are generally Capital Gains Tax exempt

- A ‘liquid’ luxury asset with price transparency and mature secondary market

See our Guide to Investing in Wine for more information.

As we all know, fine wine should not be considered as a short-term investment. At Vin-X we will always recommend a 3–5 year hold as a minimum and given the recent cycle you can see the benefits of that investment principle.

If you’re able to hold your fine wine investment longer, then that is always my advice. However, if you choose to sell, our procurement team will work tirelessly to ensure we achieve the best possible price for your wine.

Fine wine has a varying performance and returns profile compared to other assets, such as equities and other financial products, and is often used to diversify an overall portfolio. To optimise growth our portfolio management team are highly skilled at creating further diversification within your fine wine holdings by regional, vintage and brand strategies.

So, what do we need to learn from last year to invest well in 2025?

Vin-X 2024 highlights

Before laying out our thoughts for the year ahead a quick recap on the Vin-X highlights of 2024. Despite the challenging market conditions, we had an outstanding year.

Firstly, we instigated the first steps of our growth into the retail sector by completing the acquisition of a majority stake in Cador Limited, which trades as The Champagne Company. We followed this transaction up with the acquisition of Oz Wines, procurers of the best antipodean fine wines, in December and continue to look for opportunities to expand further through acquisition in 2025.

Our Vin-X Partnership program grew in 2024 to include nine wine bars across the UK where we are helping their customers to understand and get involved in the wine investment market.

Our Vin-X Partnership program grew in 2024 to include nine wine bars across the UK where we are helping their customers to understand and get involved in the wine investment market.

Our events team has grown from strength-to-strength and hosted Château Pavie at a special event with Arbuthnot Latham Banking Group early in 2024 as one of several corporate events undertaken with Vin-X clients last year.

We also hosted regular tours at London City Bond for our clients where they had the opportunity to view, and hold, their investment wines and then enjoyed tastings at the Barton-under-Needwood Vin-X Tasting Cellar with their portfolio managers.

Many Vin-X clients also attended our Sport & Wine events with their sporting heroes last year with our friends at The Sporting Club. Chris Robshaw heads up our Sport & Entertainment division and has hosted some of our clients at exclusive Tasting Dinners in the Twickenham Stadium wine cellars – more are planned for 2025.

Of course, we love any opportunity to visit our friends at the key vineyards in Europe and Chris and I were lucky to meet up with the wonderful team at Ornellaia in Tuscany and with many in Bordeaux during and around the 2023 En Primeur campaign last Spring. Some of our expert portfolio managers attended tastings at the key chateaux and we secured our strongest En Primeur allocation to date.

In 2024 we expanded our offering to our clients and strengthened our reputation and trust further within the industry.

Our thoughts on the fine wine market in 2025

We have entered the new year in a strong ‘Buyers’ Market’. This presents multiple opportunities for investors and we at Vin-X will continue to offer well priced opportunities for you to both build on your portfolio or enter the market as a new wine investor.

Our team continues to grow both in size and knowledge, with all team members qualified to at least WSET Level 2 and some working towards their Level 4. Our priority will always be to educate on the fine wine market and to help all investors to understand the market and to enjoy building a rewarding fine wine portfolio.

This year, we will continue to offer our clients access to the best wines in the world for investment and to guide them to grow profitable portfolios at a time when the market is priced to offer real value for investors.

Through The Champagne Company, Oz Wines and the Vin-X wine bars, we will continue to build on our retail growth plan. We are launching our new Vin-X Cellar Plan service and will be providing more information to our clients on that very soon.

Through The Champagne Company, Oz Wines and the Vin-X wine bars, we will continue to build on our retail growth plan. We are launching our new Vin-X Cellar Plan service and will be providing more information to our clients on that very soon.

This year we will host more of our specialist events and will return to the vineyards in Europe to provide our clients with unique access to these highly exclusive, world-class estates and their extremely special wines.

Finally, we look forward to helping our clients make the most of the market conditions in 2025 and guiding new investors in fine wine. You can find out more by contacting our expert team on 0203 384 2262, register for our Newsletter, benefit from our specialist reports and follow us across Social Media for the very latest updates.

I wish you all the best for 2025!

James Shakeshaft