Burgundy’s 2023 vintage wines are launching onto the market now! What should investors consider in the region’s wines?

The legendary labels of Burgundy are renowned globally to be some of the rarest and most valuable, making them truly aspirational additions to a fine wine collection. With the 2023 vintage En Primeur campaign now launched, is this the perfect time to invest in Burgundy?

How are conditions in Q1 2025 affecting Burgundy prices?

Current market conditions are making Burgundy fine wine more affordable and providing a significant opportunity for investors to broaden their exposure to future growth in prices in the region’s wines.

Burgundy experienced the strongest price growth during the latest bull run with the Liv-ex Burgundy 150 rising 37.5% over the year to October 2022. Its five-year performance was an impressive 115.1% growth at that stage, significantly outperforming the US equities benchmark S&P500’s 49% rise in the same period and -15.8% loss in one year.

Burgundy Bull Run Performance compared to equities

Index | YTD to 31.10. 2022 | 1 year | 5 years |

Liv-ex Burgundy 150 | 28.5% | 37.5% | 115.1% |

Liv-ex 1000 | 14.3% | 19.6% | 49.5% |

S&P500 | -19.6% | -15.8% | 49.1% |

FTSE 100 | -3.9% | -2.5% | -5.8% |

Data source: Liv-ex.com, data at 31st October 2022

The average price growth for Burgundy was 26.7% in 2022, but key labels experienced much higher increase in values.

Top 10 Burgundy brands by price growth in 2022

Rank | Burgundy Producer | Average price growth |

1 | Arnoux Lachaux | 487.2% |

2 | D’Auvenay | 127.2% |

3 | Leflaive | 94.1% |

4 | Jacques – Frederic Mugnier | 85.8% |

5 | Pierre Yves Colin-Morey | 84.1% |

6 | Francois Raveneau | 71% |

7 | Sylvain Cathiard | 66.5% |

8 | Armand Rousseau | 63.5% |

9 | Dujac | 59.7% |

10 | Leroy | 59.5% |

Source: Liv-ex Power 100 Report, 2022

Given the surge in prices during that growth cycle, it is understandable that Burgundy generally endured the harshest correction in the sector dynamic since the market peak. The Liv-ex Burgundy 150 index fell -15.2% in one year and recorded a two-year contraction of 28.9% at the 31st December 2024.

This is the current average level of discount from a potential future market uprise. As we can see from the historical data, individual wines and key vintages can achieve significantly more growth than the general trend. The scale of potential opportunity for tax-efficient gains for investors who acquire Burgundy in Q1 2025 is clearly evident.

This is the current average level of discount from a potential future market uprise. As we can see from the historical data, individual wines and key vintages can achieve significantly more growth than the general trend. The scale of potential opportunity for tax-efficient gains for investors who acquire Burgundy in Q1 2025 is clearly evident.

The annual Liv-ex Power 100 Report in recent years has revealed that Burgundy has the highest number of producers making the top 100 ranking of fine wine brands in the world. The 2022 Power 100 recorded that thirty-nine of the region’s producers made this rarified level. This softened slightly to thirty-seven in 2023 and as the market correction deepened, and buyers became more wary of high-value Burgundy, the 2024 report revealed that thirty made the top 100, still the highest regional count last year.

Burgundy’s top 5 ranked brands

Rank | 2024 / (overall rank) | 2023 / (overall rank) | 2022 / (overall rank) |

1 | Joseph Drouhin / Drouhin Vaudin (4) | Leflaive (1) | Leroy (1) |

2 | Henri Boillot (6) | Meo Canuzet (3) | Arnoux Lachaux (2) |

3 | Leroy (9) | Joseph Drouhin (5) | Leflaive (3) |

4 | Domaine Leflaive (12) | Henri Boillot (8) | Armand Rousseau (4) |

5 | Bouchard Pere & Fils (17) | Leroy (10) | Prieure Roch (5) |

Source: Liv-ex Power 100 Reports 2024 /2023 / 2022

Additional factors influencing price beyond the general market sentiment are rarity and quality of wine. Smaller and higher critically scored vintages tend to achieve an overall price premium. Of course, brand reputation adds further clout, and no region does this more powerfully than Burgundy.

Where should Burgundy buyers look for value in 2025?

Investors should consider which Burgundy brands remain the most actively traded and where there has been more sustained price performance in the longer term and combine this with the price correction and where the opportunity for growth is most evident.

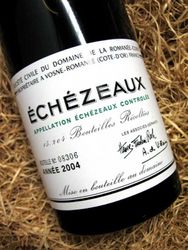

Domaine de la Romanée Conti is the most iconic Burgundy label. With just around 1,000 cases made a year and single bottle (75cl) sales of legendary vintages such as the 1945 DRC Romanée-Conti selling at auction for over $500,000 (in 2018), the label for most investors is out of reach. However, 2025 maybe the moment for some!

Domaine de la Romanée Conti is the most iconic Burgundy label. With just around 1,000 cases made a year and single bottle (75cl) sales of legendary vintages such as the 1945 DRC Romanée-Conti selling at auction for over $500,000 (in 2018), the label for most investors is out of reach. However, 2025 maybe the moment for some!

The average price correction for Domaine de la Romanée Conti wines in the last two years is -23.6% (Source Liv-ex January 2025), including -11.5% in the twelve months to 31st December 2024. DRC Richebourg is the best performing appellation of the stellar DRC brand in the last year, with average price slip of -7.8%. However, the discount on prices since 31.12. 2022 is -30.3% offering significant opportunity for future growth.

Liv-ex reports in January 2025 that Georges Roumier Bonnes Mares hit the deepest lows, with an average 44% drop over two years and 24% in the last 12 months.

The Burgundy wine that has weathered the challenging conditions best is Joseph Drouhin Montrachet Grand Cru Marquis de Laguiche, down just -1% in two years and -7.4% in the last year. Drouhin made the top five most powerful fine wine brands in the Power 100 ranking in 2024 and 2023.

How should investors view the Burgundy 2023 vintage?

Firstly, the 2023 Burgundy crop is a generous one with impressive yields fuelled by high rainfall and fair weather during the growing season. Vine management techniques such as green harvesting were deployed to control yield for optimum quality.

Critic Neal Martin published his view having tasted the embryonic 2023 wines as being “hard pushed to think of another [Burgundy] vintage so pleasurable from barrel”. He observes that the 2023 vintage combines the ripeness of 2020 with the freshness of 2017 in those wines where the Pinot Noir was well managed.

Critic Neal Martin published his view having tasted the embryonic 2023 wines as being “hard pushed to think of another [Burgundy] vintage so pleasurable from barrel”. He observes that the 2023 vintage combines the ripeness of 2020 with the freshness of 2017 in those wines where the Pinot Noir was well managed.

Neal Martin’s top scored 2023 wines were headed by Domaine de la Romanée Conti, Romanée Conti which he rated ‘in-barrel’ 98-100 points and as having the potential for perfection. He also stated that it was ‘one of the best he has ever tasted’ – high praise indeed!

Neal Martin’s top Burgundy 2023 wines

| 2023 Wine | Score |

1 | Domaine de la Romanée Conti, Romanée Conti Grand Cru | 98-100 |

2 | Domaine Marc Colin, Montrachet Grand Cru | 97-99 |

2 | Domaine Comtes Georges de Vogüé, Musigny Vielles Vignes G.C. | 97-99 |

2 | Domaine Armand Rousseau Chambertin Clos de Beze Grand Cru | 97-99 |

Source: Vinous.com

Martin scored 21 wines 96-98 points with the top 25 wines rated including 3 Montrachets, 2 Richebourgs and 2 Chambolle-Musigny Les Amoureuses.

The 2022 vintage, released this time last year, was the top traded Burgundy vintage in 2024 by volume accounting for 19.8% of the region’s wines traded. There is more supply in the 2023 vintage, and it is being well received by the critics.

The key challenge for the vignerons and their agents is pricing in the current market. Despite being a more plentiful vintage, the wines are not expected to be released at a discount to the 2022 release prices. If they price to engage the market, it could kick-start an exciting period for investors and provide a much needed boost to the start of 2025 on the secondary market.

For more information on the current opportunities to invest in Burgundy, contact our expert team on 0203 384 2262.